Empowering Entrepreneurs: Leveraging Difficult Money Finances for Organization Development

In the world of entrepreneurship, the search of development and growth frequently hinges on protecting sufficient monetary sources. Hard cash loans have actually arised as a practical choice for business owners seeking to take advantage of external financing to move their businesses ahead. While the idea of hard cash financings might seem uncomplicated, the intricacies of this economic tool hold the potential to equip business owners in manner ins which traditional borrowing might not. By exploring the nuances of difficult money financings and their implications for company growth, entrepreneurs can get beneficial understandings right into how this alternative financing method could be the catalyst for their next phase of growth.

Understanding Hard Cash Finances

Difficult money car loans are a form of funding normally protected by the value of a building, supplying a quicker and a lot more flexible alternative for consumers with certain funding needs. hard money loans in ga. Unlike traditional small business loan, hard cash finances are commonly used by personal investors or companies and are based upon the collateral value of the home instead of the borrower's credit reliability. This makes tough money financings ideal for individuals or organizations that might not get approved for traditional car loans due to credit scores concerns, income confirmation troubles, or the requirement for a rapid funding procedure

The application procedure for hard money loans is usually much faster and less rigid than traditional fundings, making them an eye-catching choice for debtors seeking to safeguard funding rapidly. While standard lendings may take weeks or also months to approve, difficult cash financings can frequently be processed in an issue of days. In addition, tough money lenders are much more eager to collaborate with borrowers on a case-by-case basis, allowing for even more personalized and flexible terms to meet the debtor's details needs.

Benefits for Entrepreneurial Development

Leveraging tough cash financings can offer considerable benefits for entrepreneurs seeking rapid service development through different financing options. One vital advantage is the speed at which hard cash lendings can be protected compared to standard bank car loans. This fast access to capital enables entrepreneurs to profit from time-sensitive chances, such as acquiring supply at a discounted rate or investing in new devices to boost manufacturing capability.

Furthermore, hard money lendings are asset-based, meaning that the financing authorization is mainly based on the worth of the security instead of the debtor's credit rating. This aspect makes hard money car loans extra easily accessible to entrepreneurs with less-than-perfect credit backgrounds, enabling them to acquire the required funding to expand their companies.

:max_bytes(150000):strip_icc()/hard-money-basics-315413_Final-cdfb8155170c4becb112da91bd673fe8-0472b1f57ff94abebddef246c221a65f.jpg)

Qualification and Application Refine

When taking into consideration difficult money car loans for business expansion, recognizing the eligibility find out needs and application procedure is vital for business owners looking for option financing choices. Lenders supplying tough money financings are mainly worried with the residential property's possibility to generate returns and the debtor's capacity to repay the funding. The application procedure for hard money fundings is often quicker than conventional financial institution loans, with decisions being made based on the residential property's value and prospective productivity of the business growth.

Leveraging Hard Money for Growth

Understanding the strategic application of different financing systems like hard money finances can significantly bolster service growth initiatives for business owners. By accessing hard cash car loans, entrepreneurs can safeguard financing swiftly without the substantial documents and authorization procedures generally associated with conventional lendings.

Furthermore, difficult money car loans offer flexibility in regards to security needs, making them obtainable to entrepreneurs that may not have considerable possessions or a strong debt history. This element is particularly useful for companies aiming to expand quickly or those running in industries with changing money circulations. Additionally, the temporary nature of difficult cash fundings can be beneficial for business owners looking for to money specific development projects without committing to long-term financial debt commitments. Generally, leveraging difficult cash for development gives business owners with a versatile financing tool to sustain their growth passions efficiently and properly.

Risks and Considerations

Cautious assessment of potential dangers and considerations is paramount when discovering the use of difficult cash financings for service expansion. Unlike traditional financial institution fundings, hard cash financings usually come with substantially higher rate of interest rates, which can raise the general price of loaning and impact the earnings of the company.

:max_bytes(150000):strip_icc()/terms_h_hard_money_loan-FINAL-b9af7690939e45d5a80e25ee55c83d40.jpg)

Final Thought

In verdict, hard money financings provide business owners a viable choice for business expansion. By additional reading leveraging difficult cash fundings properly, entrepreneurs can equip their businesses to reach brand-new heights and achieve their growth objectives.

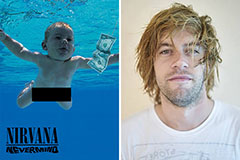

Spencer Elden Then & Now!

Spencer Elden Then & Now! Seth Green Then & Now!

Seth Green Then & Now! Nancy McKeon Then & Now!

Nancy McKeon Then & Now! Tyra Banks Then & Now!

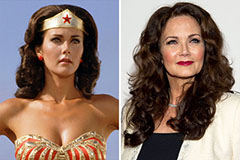

Tyra Banks Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now!